The Efficient Approach to Investment in Cryptoassets

The innovative crypto investor knows maintaining full autonomy over their cryptoassets is crucial to long-term performance of their portfolio.

Let’s take a look at some interesting progressions on the front of taxation & privacy of blockchain transactions…

Taxation Strategy for Cryptoasset Capital Gains

When there are massive amounts of money being made, you can expect the government to be following to collect their share. Regardless of where you stand on the debate of taxation of cryptocurrency gains, this will be a crucial theme in 2018, especially as we approach April in the United States (and tax season elsewhere).

One of the innovative solutions to efficient tax strategy can be borrowed from a common transaction used in the real estate world.

Rather than selling the underlying asset and realizing a capital gains event, which will ultimately run you about 30% in taxes off of the profit, one can borrow against that asset instead (in order to generate the CF they are seeking). By putting the crypto-asset in escrow and taking a loan out against the value of that asset, the investor avoids a taxable event. This is a great solution for individuals who have amassed sizeable gains but are looking to access fiat capital for any number of reasons.

Now this sounds great and all but can anyone actually do this?

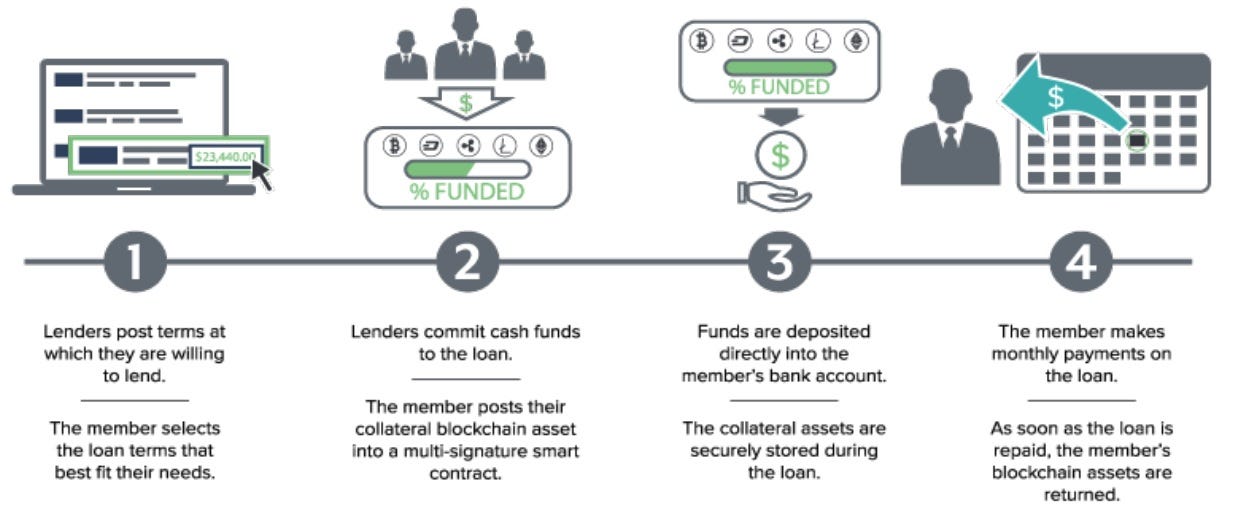

Up until now, there have been very few traditional lenders willing to loan against the value of crypto-assets. Enter SALT Lending (SALT). The following overview is from SALT’s newly-launched platform: “SALT lets you leverage your blockchain assets to secure cash loans. We make it easy to get money without having to sell your favorite investment”.

Privacy of Blockchain Transactions

One of the alluring features of crypto-assets to early adopters was the privacy of transactions. Being able to send and receive transactions off the radar from traditional regulators resulted in black market behavior, however it also served practical applications for users who were not using the privacy for illicit purposes.

As the infrastructure of the crypto industry has been built, gradually the built-in privacy features of coins like Bitcoin have been eroded.

Why exactly did that occur?

Well for individuals in the US, the easiest way to purchase cryptocurrency is through an exchange like CoinBase. In order to open an account and purchase any crypto, the user needs to provide a fair amount of personal information. Such information can and will be used to identify and track users’ capital. This results in a trade-off between ease of use (convenience) and privacy.

Privacy will be a central theme for 2018. Decentralized Blockchains with native crypto-assets should continue to thrive. As users begin to value the feature of a fully private blockchain, there will be a natural flow of capital into privacy-centric assets.

Although there are a number of other privacy centric crypto-assets, Monero (XMR) is my personal favorite at the moment. By using ring signatures and one-off public wallet addresses, Monero ensures that both the user sending and receiving a transaction do not have information related to the transaction stored on the public blockchain which can be traced back. For those of you looking to dig a little deeper, check out this piece on “How Monero’s Privacy Works”.

Monero has built a reputation as an industry leader, in terms of its development team, community and most important the gold-standard for completely private transactions.

One of the notable drawbacks of Monero has been a lack of support from hardware wallets, making storage of Monero difficult and insecure (as compared to cold storage). However, the Monero team has been hacking away furiously at this issue and we can expect Monero to be compatible with hardware wallets in 2018.

ROLE DESCRIPTION

We are looking for a Membership Manager to join the company and take on one of the most opportunistic roles the industry has to offer. This is a role that allows for you to create and develop relationships with leading solution providers in the enterprise technology space. Through extensive research and conversation you will learn the goals and priorities of IT & IT Security Executives and collaborate with companies that have the solutions they are looking for. This role requires professionalism, drive, desire to learn, enthusiasm, energy and positivity.

Role Requirements:

Role Responsibilities:

Apex offers our team:

Entry level salary with competitive Commission & Bonus opportunities

Apex offers the ability to make a strong impact on our products and growing portfolio.

Three months of hands on training and commitment to teach you the industry and develop invaluable sales and relationship skills.

Opportunity to grow into leadership role and build a team

Extra vacation day for your birthday when it falls on a weekday

All major American holidays off

10 paid vacation days after training period

5 paid sick days

Apply Now >>