From a historical perspective, 2017 will be regarded as “The Year Crypto Arrived”. Sure Bitcoin and other cryptocurrencies have been picking up steam for close to a decade now, however it was not until 2017 that cryptocurrency really hit their stride, reaching a critical mass and experiencing significant network effects from mainstream adoption.

Let’s take a look back at some of the seminole moments that shaped the historical year of crypto assets:

Total Cryptocurrency Market Cap Grows 32x

Ok, ok…we’re all aware 2017 was a parabolic year for investors in cryptocurrency. That being said its astonishing to see how far we’ve come in 365 days. I can bore you with my opinion of why this occured but the numbers tell the story.

January 1, 2017: $17.7 billion

December 31, 2017: $569.6 billion

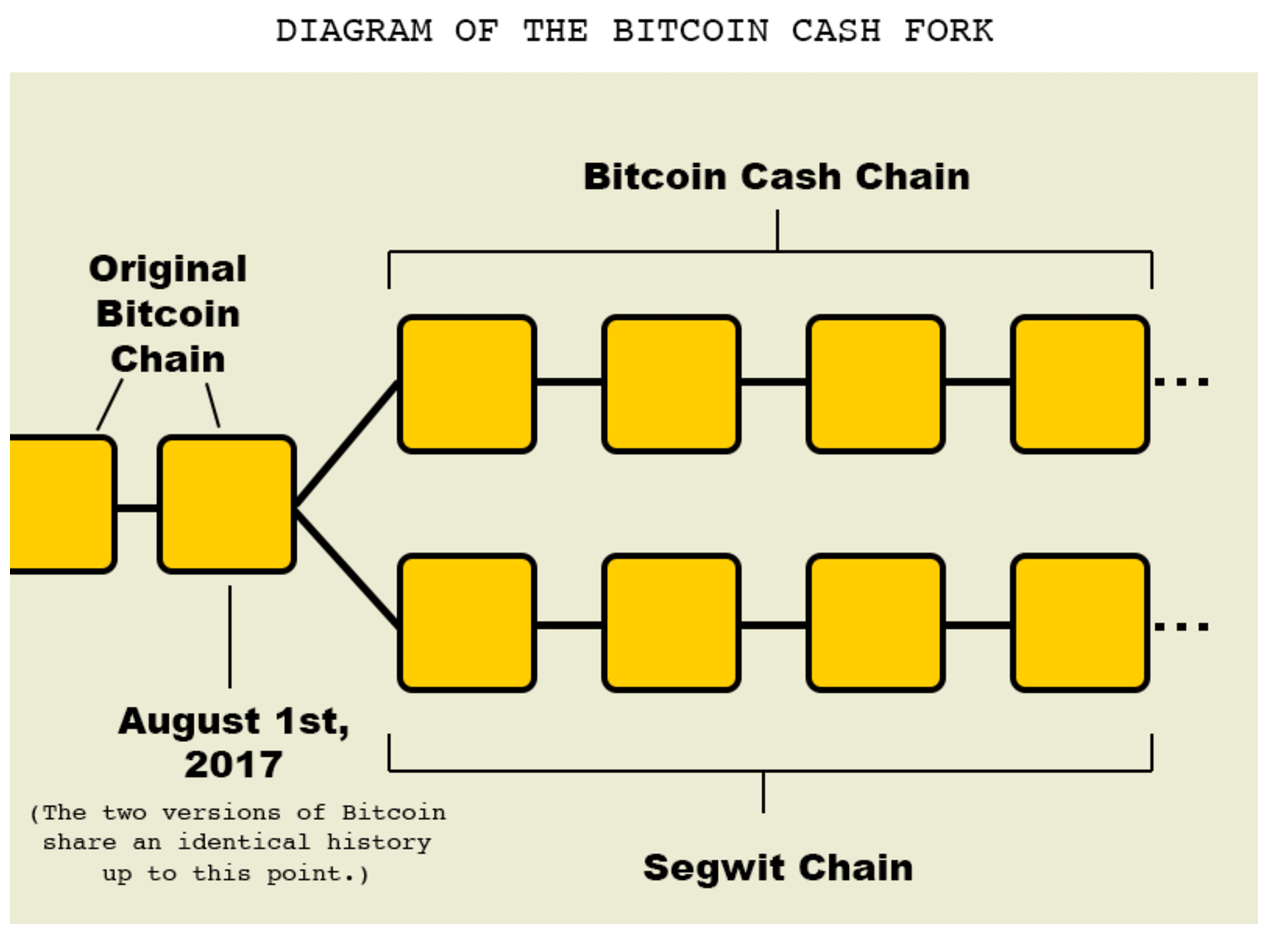

Bitcoin Cash Fork — August 1st, 2017

While the Ethereum blockchain successfully forked following the DAO attack in 2016, the proposed Bitcoin Cash hardfork brought with it a new level of FUD (Fear, Uncertainty & Doubt). While many of the major exchanges failed to support the fork immediately following the August 1st fork, the process went quite smoothly from a technological standpoint.

Although the civil war on Twitter between Bitcoin purists and Bitcoin Cash supporters carries on, we now know that there is room for competition within the Bitcoin ecosystem. As of December 31, Bitcoin Cash’s market cap of $41.8 billion is nearly 18.9% of Bitcoin. With Coinbase recently adding Bitcoin Cash to its exchanges, it appears that Bitcoin Cash is here to stay.

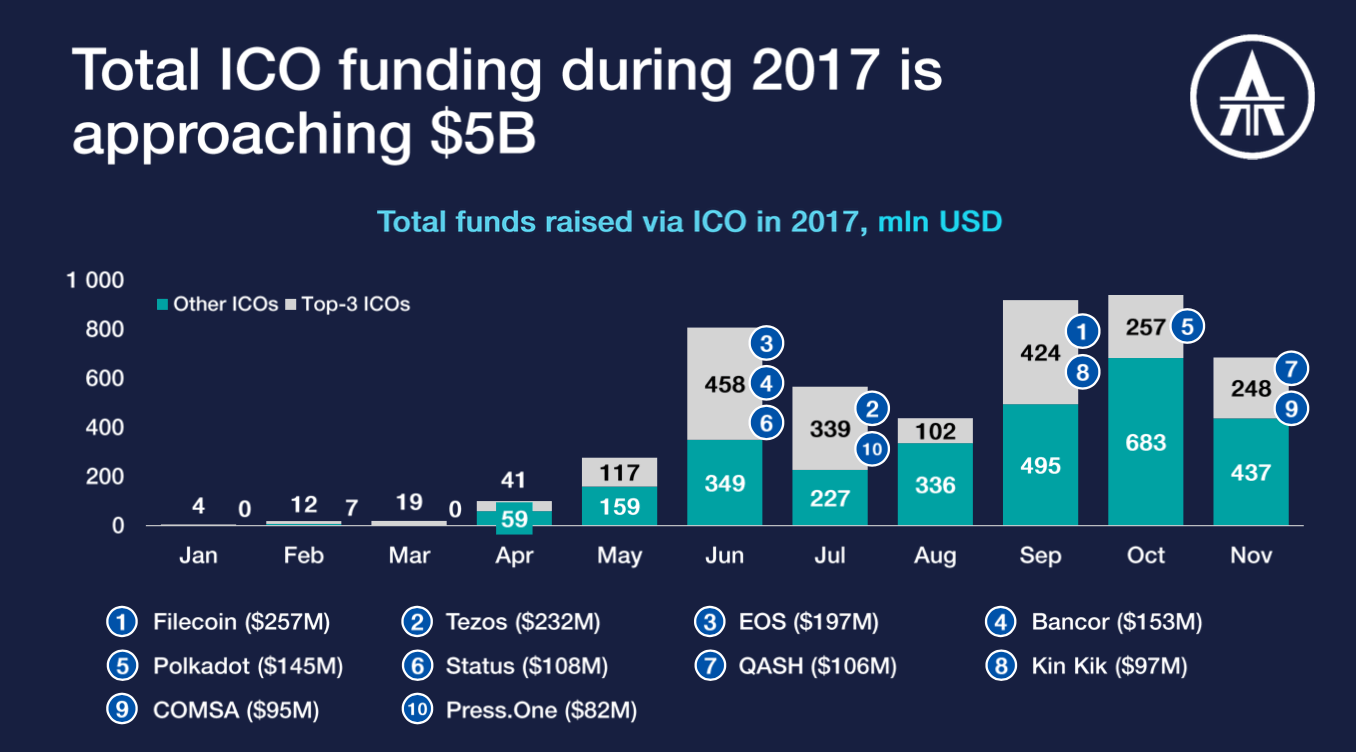

ICO Market Surpasses Traditional Early-Stage Funding

The Initial Coin Offering (“ICO”) first came on the scene in July 2013 when Mastercoin raised nearly $5m of Bitcoin in exchange for their newly-generated tokens. In 2014, Ethereum raised 3,700 BTC within its first 12 hours. However, the sentiment around ICOs coming into 2017 was that an ICO was a niche funding mechanism, put more bluntly ICOs were for projects that could not garner support from traditional Venture Capital firms.

All of that changed in 2017, when the ICO market raised a cumulative $5 billion of funding. At a current run rate of nearly $600m per month of capital raised by ICOs, the ICO market is crushing traditional early-stage funding which has a current run rate of ~$300m per month. June 2017 was the first month where the ICO market surpassed traditional VC funding and it appears there is no looking back.

While it is far too early to announce the demise of traditional Venture Capital, its obvious that early-stage capital raising as we know it has changed. There will always be a place for experienced advisory and Venture Capitalists have helped shape the world’s largest companies, however the ICO (for now) has swung the pendulum and there is a shift of power taking place.

So what does all of this mean? Well a divergence from the Sand Hill Road VC boys’ club will hopefully provide a more democratized approach to capital raising. While an exorbitant percentage of funding during the development of the Internet was centralized in Silicon Valley, New York and other tech meccas; the development of the blockchain industry will be far more diverse from a geographical and socio-economical standpoint.

Conclusion

By total market capitalization, the cryptocurrency market grew by a multiple of 32 times in 2017. While such growth rates speak for itself, the mainstream appeal of cryptocurrency is just scratching the surface.

In 2018, I envision more of the same from the crypto market (of course 32x returns are unlikely). With institutional capital knocking at the doorstep, I expect massive inflows of capital into the major cryptocurrencies. A more developed and sophisticated investor base will bring to the surface short-term growing pains, however I believe that long-term this process will legitimize cryptocurrency as an asset class.

Here’s to a great 2018, see you all on the moon!

ROLE DESCRIPTION

We are looking for a Membership Manager to join the company and take on one of the most opportunistic roles the industry has to offer. This is a role that allows for you to create and develop relationships with leading solution providers in the enterprise technology space. Through extensive research and conversation you will learn the goals and priorities of IT & IT Security Executives and collaborate with companies that have the solutions they are looking for. This role requires professionalism, drive, desire to learn, enthusiasm, energy and positivity.

Role Requirements:

Role Responsibilities:

Apex offers our team:

Entry level salary with competitive Commission & Bonus opportunities

Apex offers the ability to make a strong impact on our products and growing portfolio.

Three months of hands on training and commitment to teach you the industry and develop invaluable sales and relationship skills.

Opportunity to grow into leadership role and build a team

Extra vacation day for your birthday when it falls on a weekday

All major American holidays off

10 paid vacation days after training period

5 paid sick days

Apply Now >>